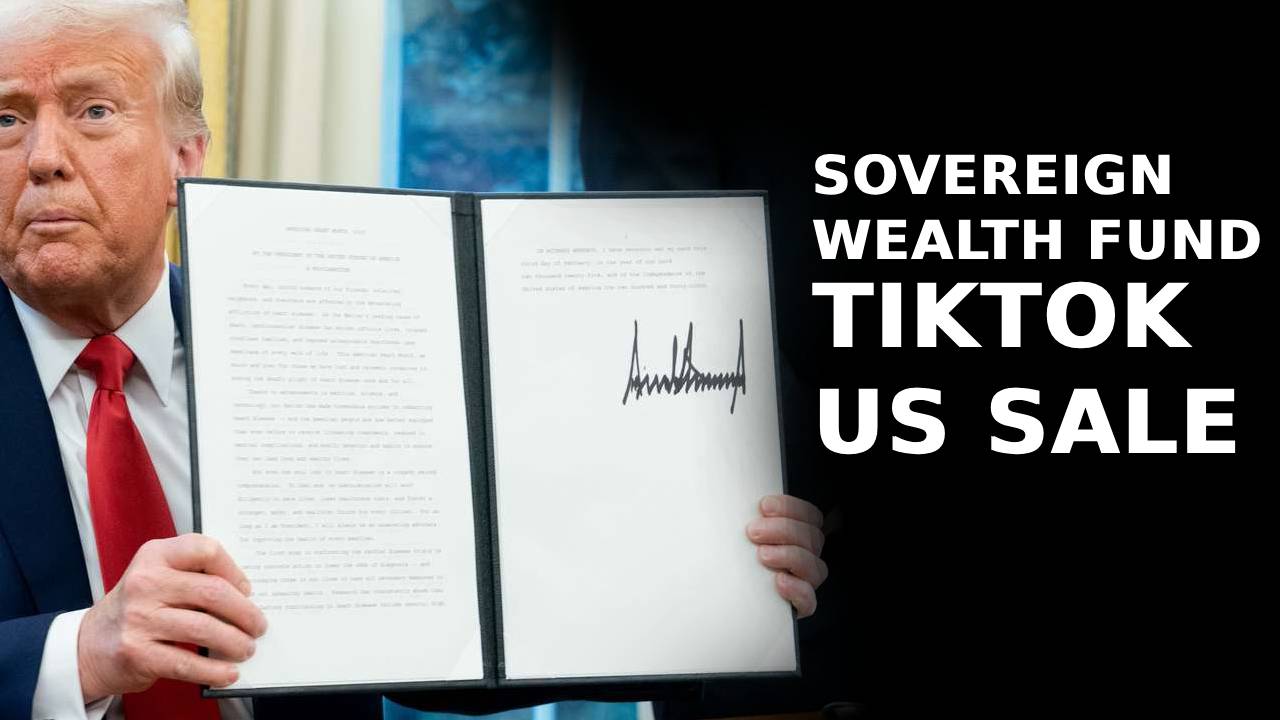

In a groundbreaking move, U.S. President Donald Trump signed an executive order on February 3, 2025, directing the creation of a sovereign wealth fund. The proposed fund could potentially place the United States among nations that use government-backed investments to bolster their economies.

1. Executive Order Details

The executive order tasks the Treasury and Commerce Departments with submitting a comprehensive plan within 90 days, covering key aspects like:

- Funding Mechanisms: Exploring possible sources, including tariffs

- Investment Strategies: Recommendations on asset management

- Fund Structure and Governance: Proposing a robust operational framework

2. Challenges in Fund Creation

Unlike traditional sovereign wealth funds that leverage budget surpluses, the U.S. faces a budget deficit. Clemence Landers from the Center for Global Development highlighted that congressional approval would likely be necessary to establish and fund the initiative.

3. Potential Financing Options

President Trump hinted at innovative funding solutions, mentioning tariffs as a possible revenue source. Treasury Secretary Scott Bessent emphasized the plan to “monetize the asset side of the U.S. balance sheet for the American people.”

4. TikTok Acquisition Speculation

Trump suggested that the sovereign wealth fund might acquire the short-video app TikTok, which faces national security concerns under U.S. law. Trump stated that a final decision would likely be made in February after ongoing discussions.

5. Expert Reactions

The announcement surprised investors and analysts alike. Colin Graham from Robeco in London noted the economic complexities of creating a sovereign wealth fund without a clear budget surplus.

6. Comparisons with Global and State Funds

Globally, over 90 sovereign wealth funds manage assets exceeding $8 trillion. Within the U.S., states like Alaska and Texas have their own funds primarily fueled by natural resource revenues.

7. Biden Administration’s Previous Exploration

Reports indicated that the Biden administration had explored the creation of a similar fund before Trump’s election, focusing on boosting global competitiveness.

Conclusion

The proposed U.S. sovereign wealth fund marks a significant shift in national financial strategy. While hurdles remain regarding funding and legislative approval, Trump’s ambitious vision aims to position the country among global investment leaders. Whether it will lead to TikTok’s acquisition or other strategic investments remains to be seen.

What is a US Sovereign Wealth Fund?

Meaning of a Sovereign Wealth Fund (SWF)

A Sovereign Wealth Fund (SWF) is an investment fund owned and managed by a country’s government. Its primary purpose is to manage the country’s financial assets and invest them to generate additional wealth. These funds are typically used by nations to make global investments and strengthen their economies.

What is the US Sovereign Wealth Fund?

If the United States establishes a sovereign wealth fund, it will be a government-controlled investment vehicle aimed at managing public assets and investing in various projects to generate long-term financial growth.

Key Features of a US Sovereign Wealth Fund:

- Funding Sources:

- Potential funding sources may include tariffs, tax revenues, and other financial mechanisms.

- However, the US does not have a budget surplus, which poses a significant challenge for such a fund.

- Investment Sectors:

- Infrastructure development (highways, airports)

- Manufacturing and medical research

- Technology and national security-related projects

- Governance and Structure:

- The Treasury and Commerce Departments have been tasked with submitting a detailed plan within 90 days, outlining the fund’s structure, investment strategies, and governance model.

Why Does the US Need a Sovereign Wealth Fund?

- Economic Competitiveness: Strengthening the US economy at a global level.

- Strategic Investments: Creating a secure and dedicated source for investing in key industries.

- National Security: Having the financial capacity to acquire or invest in sensitive technologies or platforms, such as TikTok.

Sovereign Wealth Funds Around the World:

- Middle Eastern Countries: Countries like the UAE and Qatar invest their oil revenues through sovereign wealth funds.

- Norway: The Government Pension Fund Global is the world’s largest sovereign wealth fund.

- US States: States like Alaska and Texas operate their own state-level wealth funds to support education and tax relief.

Challenges:

- Budget Deficit: The US operates at a deficit, making it difficult to establish such a fund.

- Congress Approval: Legislative approval would likely be required for funding and structure.

- Unclear Funding Mechanism: The absence of a clear funding strategy remains a significant hurdle.