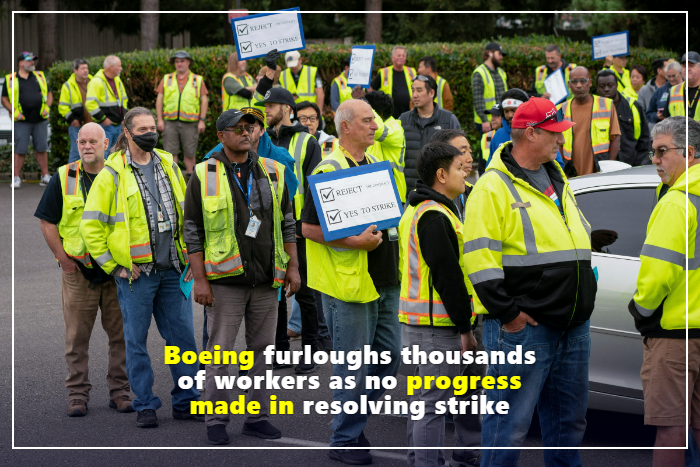

Sept 18 (Askume) – Boeing (BA.N) said on Wednesday it would temporarily ground its best-selling 737 Max after about 30,000 mechanics went on strike on Friday , halting production of other planes.

” We will be initiating temporary furloughs in the coming days, affecting a significant number of our executives, managers and employees who reside in the United States,” Chief Executive Kelly Ortberg said in an email to employees. During the strike, selected employees will be provided one week of leave every four weeks.

The strike is Boeing’s first since 2008, capping a tumultuous year for the plane maker that began in January when a door panel on a new 737 Max jet blew off in the air.

Ortberg also said he and other Boeing leaders “would accept pay cuts during the strike.”

Boeing and the International Association of Machinists and Aerospace Workers held two days of discussions in the presence of federal mediators. The union said Tuesday it was disappointed with the first day of mediation and later Wednesday said it had ended another day of talks “without any meaningful progress.”

“While we remain open to further discussions, either directly or through mediation, no other dates are currently set,” the union said. “We remain fully committed to getting our members the contract they deserve.”

Boeing did not immediately respond to a request for comment on the IAM statement.

The mass layoffs suggest that Ortberg is preparing the company for a long strike that will not be easily resolved because of workers’ anger.

Analysts say a prolonged labor conflict could cost Boeing billions of dollars in losses, deepen its financial crisis and threaten its credit rating .

“It’s unlikely that funding cuts would fully cover the costs of a prolonged strike,” said Ben Zokanos, head of aerospace at S&P Global Ratings.

In full contract talks with Boeing, the union is demanding a 40% pay rise over four years for the first time in 16 years, well above the aircraft maker’s 25% offer, which was firmly rejected.

Brian Bryant, international president of the IAM, said the layoffs and pay cuts were akin to “smoke and mirrors” because the company had previously spent the money on executive bonuses and compensation.

“This is part of their plan to make it look like they’re saving money,” said Bryant, who was picketing with Resilience members in the Seattle area on Wednesday.

“The ball is in Boeing’s court. They can resolve this strike tomorrow,” Bryant said. This would require restoring fair wages, pensions, bonuses and health insurance.

Ortberg said in an email to employees that the company will not take any action that would impede our ability to fully recover in the future. All activities critical to our safety, quality, customer support and critical certification programs will be prioritized and continued, including 787 production.

The company has about 150,000 employees in the United States. It is unclear which employees will be affected by the furlough. The union representing Boeing engineers said members were not affected.

According to Askume, the six-day strike also poses a risk to the company’s vast network of suppliers, some of whom are considering furloughs.

“Suppliers are definitely concerned,” said Nikki Malcolm, chief executive of the Pacific Northwest Aerospace Alliance. “If this continues for a long period of time, it will have a significant impact on suppliers.”

Production stopped

The strike halted production of Boeing’s 737 Max narrow-body jet and 777 and 767 wide-body planes, delaying deliveries to airlines.

However, a major Chinese lessor said it had placed a new order for 50 Max jets on Wednesday for delivery between 2028 and 2031, suggesting long-term demand for Boeing planes remains unchanged.

The manufacturer said on Monday it would freeze hiring to cut costs as it already has $60 billion of debt on its balance sheet.

The company has also halted most orders for all Boeing jet programs except the 787 Dreamliner, which will hurt its suppliers.

One senior supplier dismissed the latest announcement as a “panic situation” and said it reflected Boeing’s lack of room to act with its already stretched balance sheet.

“They better compromise; they’re too close to the abyss,” the supplier said, speaking on condition of anonymity.

Boeing shares are down roughly 40% so far this year.