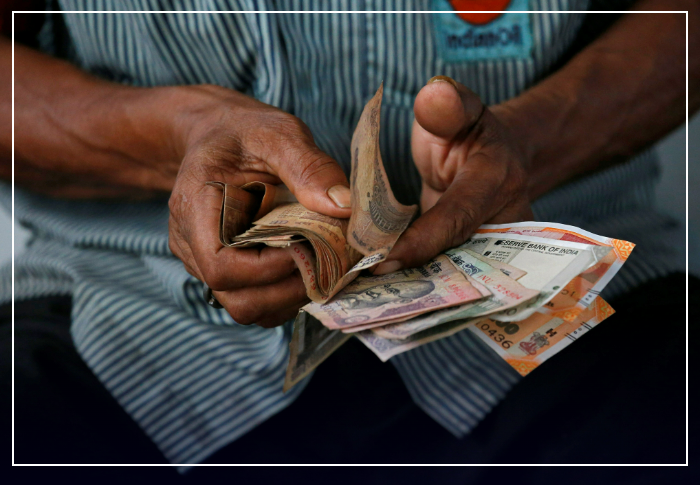

MUMBAI, Oct 3 (Askume) – The Indian rupee is likely to open weaker on Thursday after an assessment of U.S. labor market conditions raised expectations of the Federal Reserve raising interest rates modestly next month, giving a boost to the dollar.

The conflict in the Middle East and its possible impact on oil prices is expected to put further pressure on the Indian currency.

One-month non-deliverable forwards showed the rupee opened at 83.92-83.94 against the dollar, compared with 83.82 on Tuesday. Indian financial markets were closed on Wednesday for a public holiday. The rupee is not far from its all-time low of 83.9850 hit a month ago.

“The rupee has now retreated to the higher end of its current range, in line with the changing outlook for rate cuts by the Federal Reserve,” said Shrivast Puni, managing director at QuantArt Market Solutions.

He said the USD/INR will remain in the 84-84.10 zone unless the US employment data comes in higher than expected on Friday.

The US dollar index rose for a fourth consecutive day and hit a three-week high, on expectations that the Federal Reserve will cut interest rates by 25 basis points at its November meeting, up from 50 basis points last month.

The dollar got a boost after data on Wednesday showed U.S. private payrolls rose more than the previous month, raising expectations for strong monthly non-farm payrolls data due on Friday.

The data supports recent comments from Fed Chairman Jerome Powell that the Fed is in no rush to cut interest rates.

At the moment, the probability of a 50 basis point rate cut next month in the futures market is only one-third, down from about 60% a week ago.

At the same time,Oil prices rose on Thursday on concerns about escalating conflict in the Middle East .

key indicators:

** One month non-payable is Rs. 84.04; 1 month prepaid domestic premium is 11 paise

**USD index hits 101.75

** Brent crude futures rose 0.9% to $74.6 a barrel.

** Ten-year US Treasury yield is at 3.79%

** Foreign investors sold Indian stocks worth $767 million on September 30, according to NSDL data.

** Foreign investors bought Indian bonds worth $17.6 million on September 30, according to NSDL data.